I know I’m not the only person who thought credit cards were a mythical source of infinite money. I mean, come on. I saw my mom swipe the card, put it back in her wallet, and get the groceries. I understood it had to be some form of payment since it was in her wallet, so naturally, as any logical 6 year-old would assume, I thought it was adult-exclusive magic.

Now that I’m a little older , I’ve come to understand credit is not as simple as I initially thought. There are various types of credit and creditors, all of which offer different rates, have different fees, and are evaluated differently.

With countless different companies and credit types, how on Earth can creditors keep track of each individual person’s borrowing and repayment habits? Two words my friend, credit score.

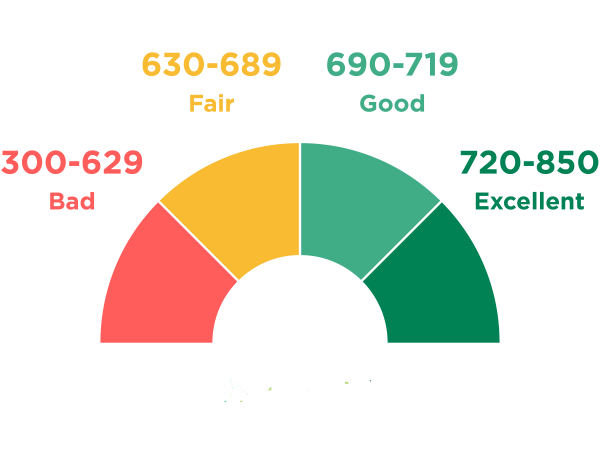

Your credit score is a numerical measurement of how reliable you are as a borrower.

This score is determined by these programs called scoring models, which compile the data from your credit report and use statistical analysis to determine what your credit score is.

Having a stronger credit score comes with a multitude of benefits: waived fees, lower interest rates, higher credit limits, and waived deposits on things like phones or computers, to name a few. Inversely, a lower credit score will result in higher interest rates and less incentives.

Now that you know what credit is, I’m sure you’d like to know what exactly is being considered when calculating your credit report. After all, how can you improve your score without knowing what affects it?

What Factors Affect My Credit?

Your credit score is mainly a culmination of 5 elements: credit usage, payment history, credit history length, credit mix, and derogatory marks.

In other words, how much of your credit limit is being used , how well you’ve been doing with paying off any accrued debt, how old your credit is, the amount of different lines of credit you have (ie. a loan, credit card, or a payment plan), and if you’ve experienced any major credit events like a foreclosure or declaration of bankruptcy.

Credit Usage

Credit usage is fairly important, with it being about 30% of your score. This is determined by measuring the percentage of your credit limit that is being used. So if your limit was $2,000 and you used $1200, that’d be 60% usage.

The reason for this is that higher usage indicates to lenders that you are spending more, and therefore a higher risk borrower. It makes sense, if you spend more credit you have to pay more money, the more you have to pay the less likely you are to pay it all.

Its for that reason that experts recommend staying near the 30% utilization mark. So if your credit limit is $200, you’d want stay around $60. It won’t be the end of the world if you have a high utilization in the beginning, as you’ll likely have a card with a small limit. Just try not to build a habit of using most of your credit limit, as over time the points you’ll lose will add up.

So for those of you just starting with a secured credit card, try to use it to pay for a Netflix subscription or something of a similar nature.

Since your usage is calculated with all of your types of credit, your utilization should go down as you get more cards and higher limits. So if you have a $5000 card and a $4000 card and use $2250 combined on them both, your utilization is 25% (which is the average American credit usage) , which looks way smaller than something like $160/200, which is 80%.

Payment History

![How To Pay Your Credit Card Bill & Avoid Interest Fees [2021]](https://upgradedpoints.com/wp-content/uploads/2019/10/Credit-Card-Statement.jpg)

Paying bills on time accounts for around 35% of your FICO® score, so it is safe to say punctuality is pretty important.

Repeatedly missing payments or being late will reflect poorly on your credit report, so try to pay off debts as soon as they’re posted. Luckily, most major lenders make tracking your balance and repaying it very simple with their mobile apps.

Credit History Length

Your credit history is a complete report of how you’ve managed all of the debt you’ve incurred so far. It will show how much you’ve paid already, the consistency, as well as any remaining balances.

In terms of improving your history, make a habit of repaying your balances in a timely manner, ideally fully repaying them when possible. There is very little you can do to change this in the short term, but if you build good repayment habits you’ll find that over time, your credit history will have an increasingly positive impact on your score.

Derogatory Marks

These intentionally bring your credit score down. You will receive these for instances of undergoing foreclosure, bankruptcy, defaulting on a loan, missing payments, or a similar debt event.

These stay on your report for seven years, or ten in the case of Chapter Thirteen Bankruptcy! So when you can, definitely avoid these.

An additional factor to be aware of is total inquiries. When applying for a credit card or loan, the lender will always check your credit score. If you apply for too many lines of credit in a short period of time, it can count against you.

From the lender’s perspective, you seem higher risk because you are applying for several lines of credit within too close of a timespan. These go away quicker than derogatory marks though, usually after just two years.

Credit Mix

Taking up 10% of your score, it is represented by your total debt as well as by evaluating the different ways that you receive and use credit. Normally lenders prefer when you have different types of credit.

But what are those types of credit?

What Are The Main Types Of Credit?

When you receive credit, it will be one of these four types:

- Installment Credit

- Revolving Credit

- Open Credit

- Non-Installment Credit

Installment Credit

Installment credit is, in layman’s terms, similar to a fixed loan. You provide at least two separate payments until your balance is rectified, and this will normally be at some form of interest rate.

Typical examples of this would be a mortgage, auto loan, or personal loan.

Since this credit type doesn’t allow a balance to be carried over from month to month, late penalties are usually the only fee being charged, but in the case of a mortgage an origination fee might also apply.

If you’re just getting started with building your history, I would recommend avoiding these lines of credit for now. You’ll get much better mortgage rates and auto loan rates if you wait until you have a “good” or “excellent” score.

Revolving and Open Credit

Revolving credit is a credit type where the borrower’s balance can “revolve”, or carry on to the next month. There is normally a monthly minimum, with the remaining balance likely having some form of interest applied to it. Open credit allows the borrower to make repeated withdrawals up to a certain amount, and then make payments until the amount is returned in full.

These credit types may sound familiar. If they do, that’s because credit cards fall into this category.

I spoke with a couple people and asked about their first credit card stories, only to find they both had a fairly common theme: they got the card, bought something that was unaffordable to them with only the cash they had on hand, and then subsequent months of paying off a purchase that either maxed out their credit limit, or came very close.

My manager went on a vacation to Hawaii with his girlfriend when he got his first credit card, quickly racking up a tab of over $2300! When he returned, the credit debt he incurred followed too. He didn’t get to go on any vacations for a while after that.

My friend decided the first thing he’d buy with his new credit card was a completely kitted out PC and a bunch of electronic accessories. You’d swear he was a gaming streamer with his double monitor setup, multi-thousand dollar computer, and color-changing LEDs. But in fact, he was just a normal busser, who spent the next several months paying more than what he originally spent on his setup thanks to interest.

Revolving and open credit can be a wonderful way to build your credit history in a manner that you are in much more control of, but it also gives people a false sense of security. Just because you can buy a lot of things with your credit, doesn’t necessarily mean you should. You may not be paying for it directly out of pocket in that moment, but you are still paying for it, and often you’re paying more over time than you spent in that moment anyways.

Non-Installment credit

This is the most simple form of credit. Non-Installment credit, also referred to as service credit, allows the borrower to pay for the balance for the service or membership at a later date, usually the end of the month. Missing payments will result in a late fee, penalty, or cancellation of that service.

This is the category that utilities, your phone bill, and retail store charge accounts fall into.

As you get older and progress to different stages of your life, your credit mix, limits, and needs will all change. Regardless of what those amounts are, it is imperative to remember that the spending decisions you make in the moment can have long-term consequences.

Avoid letting balances carry over from month to month, and do your best to pay more than the minimum if you can’t afford the full amount yet. Developing good spending and payment habits early on is one of the best things you can do for yourself, which is why it is so important to understand how the system works.

Eager to learn more about financial literacy? Subscribe to my email list so you always know when I make a new post! Thanks for reading!